Of course scams have been around for ever (yes even before the internet). In the 1950s one of the more popular Newspaper advertising scams went something like this: “Send a ten pound postal note to the address below, with a self-addressed postage paid envelope, and we will provide you with instructions and equipment to halve your power bills”. Those that did, duly received their envelope back with a pair of very cheap plastic scissors complete with detailed instructions on how to actually cut the phone bill in half!

Now with the internet, the so called scammers have the world to play with, so with billions of people connected to the internet their net is much wider and of course more sophisticated.

One of the more popular categories of scams is the phishing [fish-ing] email. These emails are designed to steal your identity, they generally ask you for personal information or direct you to websites or perhaps phone numbers to call where you are asked to provide personal data.

Phishing e-mail messages take a number of forms:

- They might appear to come from your bank or a company you regularly do business with, or even from your social networking site, if you have one.

- They might appear to be from someone you know. Spear phishing is a targeted form of phishing in which an e-mail message might look like it comes from your employer, or from a colleague who might send an e-mail message to everyone in the company.

- They might ask you to make a phone call. Phone phishing scams ask you to call a customer support phone number. A person or an audio response unit waits to take your account number, personal identification number, password or other valuable personal data. The phone phisher might claim your account will be closed if you don’t respond.

- They might include official-looking logos taken directly from legitimate Web sites, and they might include convincing details about your personal information .

- They might include links to spoofed Web sites where you are asked to enter personal information.

- It seems certain scammers have been doing the rounds of most of the New Zealand Banks.

This is an example of a scam email I received, it landed in my Junk e-mail folder.

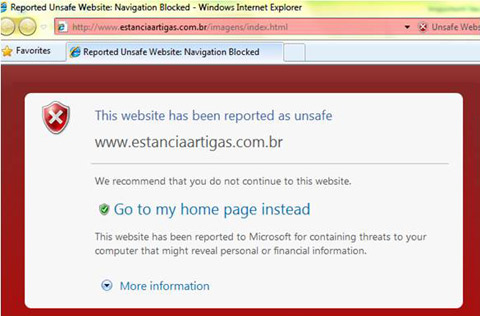

When I clicked onto the log In link this is what came up:

My suspicions were confirmed – a hoax! That had been dealt to by having the site blocked by Microsoft and anyway it’s definitely unlikely with an address ending in .com.br (br is from Brazil) it had anything to do with a New Zealand bank.

You can’t always rely on Microsoft, or anyone else for that matter, to save the day and identify the hoax sites for you, especially if they are “fresh”. So be on your guard with phrases like:

“Verify your account.”

Almost without question banks will not ask you to send passwords, login names, or other personal information through e-mail.

“You have won the lottery.”

The lottery scam is a common phishing scam, and even has its own category – Advanced Fee Fraud. A common form of Advanced Fee Fraud is a message claiming you have won a significant sum of money, or you will be paid a large sum of money for little or no effort on your part. The lottery scam often includes references to large well-known companies.

“If you don’t respond within24 hours, your account will be closed.”

These messages try to trick you to respond immediately without thinking and might even claim your response is required because your account is in jeopardy .

Another form of hoax that might catch you out is the Masked Web Address.

Web addresses that resemble the names of a well-known organisation are slightly altered by adding, omitting, or transposing letters. For example, the address of “www.seniornet.co.nz” could appear instead as:

www.seniornets.co.nz

www.senoirnet.co.nz

www.verify-seniornet.co.nz

This is called “typo-squatting” or “cybersquatting.”

Typo-squatters and cybersquatters may also create more menacing scams, such as downloading malicious software applications and spyware onto unprotected computers that connect to their sites.

And what about Nigerians!

The so-called “Nigerian scam” is one of the longest running scams. In fact, it predates the Internet and email. The scams are also known as “419 scams” after the appropriate part of the Nigerian criminal code. In spite of the longevity of this type of scam and the large amounts of publicity it has received, many people around the world are still being conned out of substantial sums of money.

The scam works like this. You receive an unsolicited message detailing some sort of business proposition, request for help, notice of inheritance, or opportunity to help a charity…. etc. The messages all claim your help is needed to access a large sum of money, usually many millions of dollars. The first message enlists your help to obtain the money, subsequent messages follow the theme of the Advanced Fee Fraud – asking you to front with some money in order to obtain the large dosh!

Don’t be fooled

Always look closely at the senders email address or the website they direct you to.

Use spam filtering technology.

Don’t make investment decisions based on anonymous e-mails you receive.

Don’t open attachments in unsolicited e-mails.

Use an Internet service provider (ISP) or e-mail provider that has implemented Sender ID Framework (a technical solution to detect and block spoofed e-mail).

dawn1 - 14 years ago

Thank you for a very easy to understand article,I have found it to be informative on this subject,one that we all need to have knowledge of to keep us safe in these days of high tech.