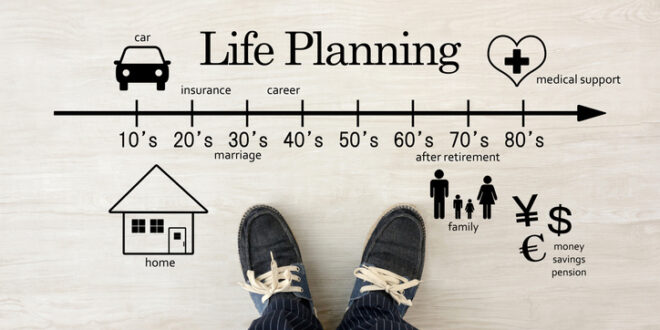

Throughout our lives, our journey is marked by many significant milestones. If you reflect to when you were just a wee baby, your first steps, your first day of school, your first birthday, your first word, are all milestones. At some stage you land your very first proper job and then perhaps go on to buy your first home and then maybe you start a family. While the specifics of these milestones may differ for everyone, the fundamental ages and stages of our lives have stuck to a universal narrative.

When it comes to money and managing your finances, each stage brings new knowledge and experience, as well as challenges. Lets delve into these distinct ages and stages, exploring the intricacies of navigating this crucial financial evolution.

Childhood ( 0 years – 12 years)

Looking back on our childhood, our earliest experiences with money will have helped shape the foundation of our money mindset. The lessons and experiences from your childhood are likely to exert a lasting impact on your present financial decision-making. Reflecting on your early memories of money—whether it was openly discussed in your household or a source of stress for your parents—can offer valuable insights. Consider how you managed pocket money during your youth; such reflections may unveil connections between your current behavioural patterns and the practices established in your childhood. And with this understanding can come the ability to change these patterns, if necessary.

This is also a great reminder that we have a responsibility for shaping the money mindset of the next generation.

Youth ( 13 years to 20 years)

These years tend to be all about instant gratification. Think about a time where you may have received pocket money for doing a ‘chore or a task’ – did you immediately save it or did you want to spend it on lollies and excitement.

As we transition from our late teens into early adulthood, we unfurl our newly gained “financial wings” of independence. Whether heading off to university or embarking on our first real jobs this phase marks the initiation of learning the ropes of cash flow management and household budgeting. This age group these days have access to their own credit cards, buy now pay later schemes and what may have seemed innocuous in childhood can potentially transform into detrimental habits, leading to the accumulation of costly debt.

Simultaneously, cultivating positive habits during this phase of life can establish a foundation for sustained financial security and success. A comprehensive grasp of the power of compounding interest, both in terms of wealth accumulation and debt management, empowers them to leverage one of the most influential factors in financial growth: time. During early adulthood, time becomes a valuable ally. If you haven’t joined KiwiSaver by the age of 18, automatic enrolment upon commencing a new job provides a significant advantage, offering an excellent head start for saving towards milestones like your first home or retirement.

It’s also important for the ‘youth’ to understand the differences between ‘good’ debt (education, mortgages etc) and ‘bad’ debt (credit cards, buy now pay later, and personal loans). An understanding of this helps them invest in themselves and in assets that appreciate and save for what they want to avoid them getting into short-term debt.

Middle ( years 20 to 50s years)

This is where it gets ‘real’

As we progress in our professional careers our income tends to rise. However, accompanying this upward trajectory are potential increases in expenses, often due to lifestyle inflation. Hopefully, having learnt and adopted good financial habits early on, these will now start to pay off. The establishment of an emergency fund ( typically 3 months of expenses) in the earlier years proves invaluable, serving as a buffer against added stress in the face of unexpected challenges such as a car breakdown or a family emergency. KiwiSaver over these years is a constant and our reward for contributions could include being able to draw down on these funds to purchase a first home. Also, with disciplined financial management, adjusting budgets and spending becomes feasible, enabling us to navigate the heightened costs associated with raising a family for example. During these years, we ideally need to keep saving and/ or investing.

Are you currently in the process of trying to turn old money habits around?

Are you talking to your Kids/ Grandkids more about money?

Don’t worry – its never too late to change!

Retirement (years 65+)

Retirement should mark the start of what are often called our golden years; the reward for a lifetime of work and service. Regrettably, a considerable number of New Zealanders find themselves approaching retirement without sufficient savings to ensure a comfortable lifestyle. Theoretically, this phase involves downsizing homes and reducing overall expenditures, but it coincides with a decline in income. Relying solely on the pension, especially in the current climate of a cost-of-living crisis, presents considerable challenges. The introduction of KiwiSaver was precisely intended to address this issue.

To retire “comfortably”, according to Massey University’s latest Retirement Expenditure Guidelines, a couple in one of NZ’s main cities will need to have saved $969,000. Basically, a million dollars. Knowing that the decisions we make and habits we form in the earlier stages of life can dictate how close to this goal we can get. Understanding your money mindset and being clear about your priorities for whatever stage of life you’re in will help you make better decisions for now, and for the future.

If this article has raised some familiar feelings, do not worry, you are not alone. FoxPlan are here to help. If you are keen to learn more please visit Foxplan.nz or reach out to us on 0800 NO STRESS/

The information provided and opinions expressed in this article are intended for general informational purposes only and are not financial advice or a recommendation.

Join the Discussion

Type out your comment here:

You must be logged in to post a comment.