According to the latest Financial Services Council (FSC) research report, Money and You: Young People and the Cost of Living Crisis. 74% of Gen Zers and 61% of millennials haven’t calculated how much they need in retirement.

“It’s not the best news, but it’s not entirely unexpected,” comments Brodie Haggerty, a Financial Adviser at FoxPlan. “Many of the young individuals we engage with haven’t delved too much into the performance of their KiwiSaver accounts and a significant number are unaware of the value of NZ Super!”

The current New Zealand Superannuation stands at slightly over $400 per week for a couple cohabiting and just over $500 per week for a single individual. Despite being viewed by many as an entitlement, there is a mounting worry that NZ Superannuation alone may not suffice for most New Zealanders. Supplementing your NZ Superannuation with a healthy KiwiSaver balance is a must.

Planning for your retirement doesn’t have to be a complex or lengthy process. A simple way to start could be consulting with a Financial Adviser and crafting a tailored KiwiSaver plan. Considering the potential duration of retirement—potentially spanning 30 years—it becomes evident that initiating savings and investments for retirement at an early stage significantly enhances your financial prospects in the long run. The sooner you start saving and investing for your retirement, the better off you’ll be.

Start Planning for your 25 – 30 year holiday!

Putting off thinking about retirement is a common tendency, especially when we’re young. After all, everything will sort itself out in the end, right?

But what if it doesn’t? What’s the plan then?

While it’s possible to make a realistic assessment of your financial standing, articulating personal goals and deciding how you want to spend your time during retirement can be a challenging task.

So, how much is needed for a comfortable retirement?

If you’re envisioning a retirement in one of New Zealand’s major cities, complete with additional luxuries and indulgences, it’s probable that you’ll need to have accumulated a savings of at least $484,500 — and the same applies to your partner.

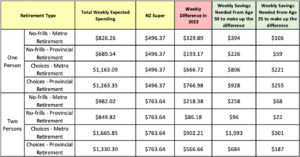

This insight comes from the latest Massey University – Retirement Expenditure Guidelines. The guidelines are updated each year, giving an overview of how much it costs to have a “no frills”, bare-bones retirement, and a “choices” one, with a few extras.

To make it easier and so you don’t have to trawl through 22 pages of research we have broken it down into a simple table:

*A one-person household in a metropolitan area on a no-frills retirement would spend $329.89 more a week than they received in the pension. The same person in a provincial centre would be short $193.17.

*A couple in a metropolitan area with a no-frills lifestyle would be short $218.38 a week, and $86.18 in a provincial area.

FoxPlans 3 Step Guide to getting started.

1. Clarity – Know where you are currently at

- Who is your current KiwiSaver Provider?

- What kind of fund are you in?

- Are you still in a default find from when it was set up?

- What kind of lifestyle do you want during retirement?

2. Insight – Working out what you could be missing

- Check out FoxPlans KiwiSaver Calculator to see what your KiwiSaver balance will be at retirement and have fun adjusting your contribution rate or your fund choice to see how this will impact your balance

- Could you afford to place more into your KiwiSaver or would an investment strategy help you get there?

- Are you planning on using your KiwiSaver for your first home or just retirement?

- Did you adjust your KiwiSaver for your first home purchase but haven’t reviewed it since?

3. Partnership – Talking to an expert

- It’s well documented that financial advice can add long-term value to your savings

- FoxPlans dedicated team of Financial Advisers can help you with your KiwiSaver and they can meet online or at our offices to offer you no obligation KiwSaver Advice

- FoxPlan’s Financial Advisers can help you with so much more than KiwiSaver. We can help with investment strategies, retirement planning and Have systems in place to show you ‘when’ you might run out of money during retirement.

A FoxPlan Adviser will help you understand the following:

– What KiwiSaver fund type will help you achieve your goals

– How changing your contribution rate could increase your KiwiSaver balance at retirement by $100,000’s

– How to maximise your savings with the KiwiSaver Government contribution each year

– What your risk tolerance is, and how this might affect your KiwiSaver account settings

– How often you should be reviewing and adjusting your KiwiSaver plan

If this has peaked your interests and raised some thought for concern, why not reach out and have a no obligation chat with one of our advisers – we have made it really easy to book a time, just click here

Armed with all this information and knowing all your options and what works for you and your goals, I think you will agree you might be in a more suitable position to make Smarter Financial Decisions

Join the Discussion

Type out your comment here:

You must be logged in to post a comment.